Issuing Credit Notes to Your Customers

Credit notes are used to reduce the amounts previously invoiced to customers. For example, if you invoice a client for a service and you do not complete the work, you can create a credit note to reduce the invoice value, meaning the customer owes you less, or nothing at all (depending on the amount of the credit note).

How to issue a credit note to your customers

In Quant, creating a credit note is the same as creating an invoice. Go to Enter Transactions > Customers Tab > New > Invoice.

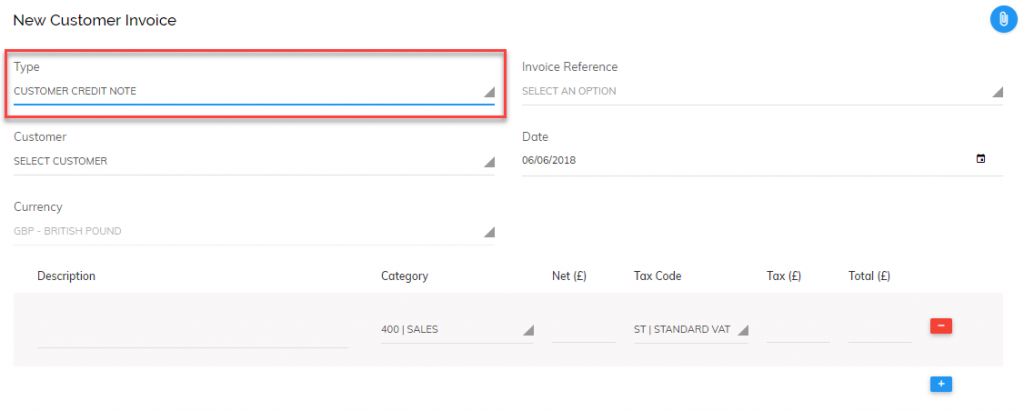

Then simply change the transaction type from ‘Customer Invoice’ to ‘Customer Credit Note’ as below:

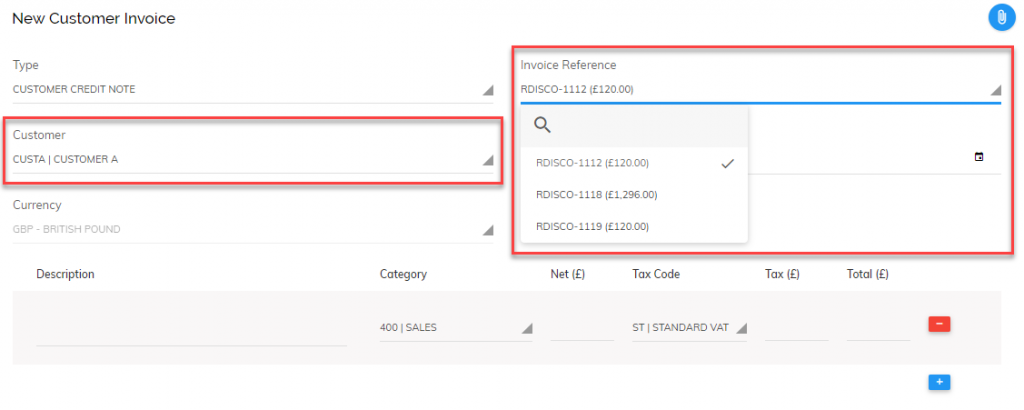

You can then select the customer the credit note is being issued to and the invoice it relates to. Next, you simply add a description and the amount to reduce the invoice by.

In Quant, a credit note must be assigned to an invoice for the following reasons:

- It reduces the scope for error. If payments on account were allowed, user error could mean negative customer accounts were possible, or you could lose track of which credit notes apply to which invoices.

- VAT complications. If a credit note is not assigned to an invoice Quant does not know how to treat the VAT, i.e. it could relate to a sale that was a standard rate, reduced rate, exempt or outside the scope of VAT.

- It forces workflow to be in a methodical order, i.e. credit notes cannot be created before the invoices.