Adjustments

What are Adjustments?

Adjustments (also known as journals) are used to move an amount from one category to another. Adjustments can be used to correct errors (especially when transactions are locked to a previous VAT return) or for bookkeepers/accountants to adjust for things like loan interest, depreciation or Corporation Tax owed (usually in the ‘year-end adjustments’).

How to use Adjustments in Quant

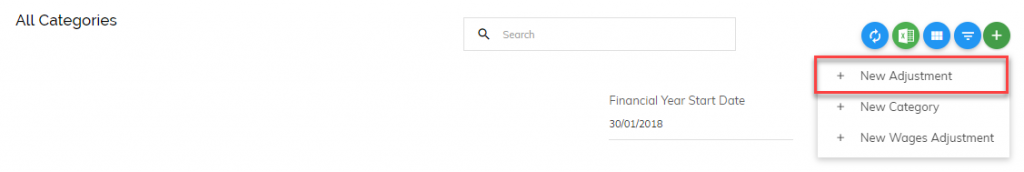

Go to Categories > + (new) > New Adjustment

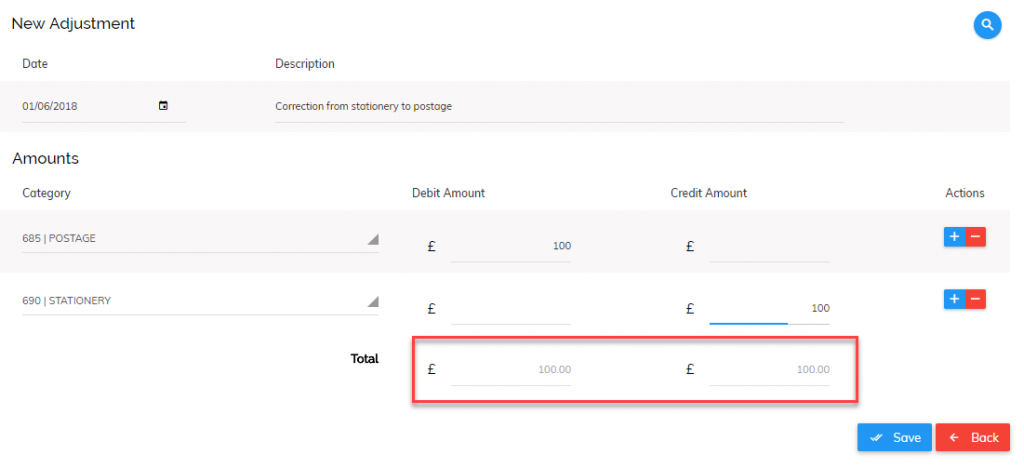

You will then be presented with the adjustment screen.

The above correction shows an adjustment from the stationery category to the postage category. The debit amount total must always equal the credit amount total. Once saved, this will increase the postage category by £100 and reduce the stationery category by £100.

You can easily view all previous adjustments by clicking on the magnifying glass symbol on the top right.

Adjustments are not always the best way to make corrections. Sometimes it can be better practice to edit the incorrect transactions if they have not been included in previous reports or VAT returns. If you are unsure about how to use adjustments then it is always best to check with your bookkeeper/accountant first.